May 23, 2017

May 23, 2017

Is Trump’s new tax plan making filing simpler, or is it really just a helping hand for the wealthy?

We’re reminded daily of the new guy in town…or office. Whether that reminder comes from seeing his face on a t-shirt or a protester’s sign outside your office window is a different story. Let’s put the opinions aside for a moment, shall we? If all goes according to Trump’s proposal, many changes will be taking place in the tax world. Here’s a breakdown of Trump’s new tax plan.

There will only be three tax brackets.

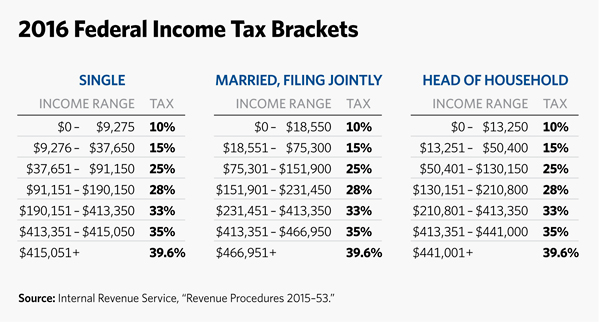

Currently, there are a total of seven federal income tax brackets. We each fall into one of them based on our income and filing status. For the 2016 tax year, they were as follows:

If and when President Trump’s plan is passed, these seven tax brackets will be narrowed down to just three:

- 10%

- 25%

- 35%

The income ranges are yet to be determined within each bracket. As you can imagine, this has made many Americans weary as it could end up being a significant change to get accustomed to; for richer and poorer.

The Standard Tax Deduction will be doubled.

When filing your tax return, you have the option to either claim the standard deduction or itemize your deductions. One would typically itemize if their expenses add up to cost more than the standard deduction amount. As of right now, the standard deduction for individual taxpayers is $6,350 and $12,700 for joint filers. Trump’s new tax plan aims to double those amounts, many who currently itemize would predictably just claim the standard deduction instead. Expenses can (but typically wouldn’t) add up to more than the new standard deduction amount. Finally, you won’t have to shove those random receipts in a shoebox under your bed until April!

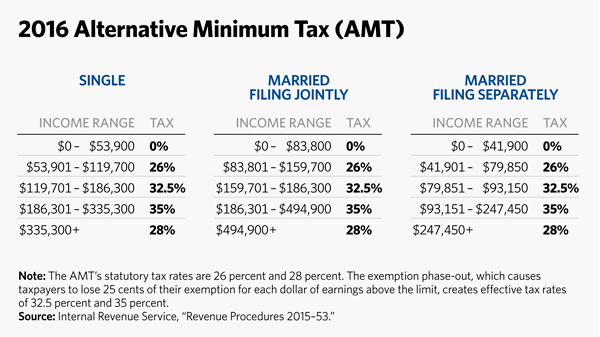

Repeal the Alternative Minimum Tax (AMT)

The AMT was originally designed to prevent the higher-income earning Americans from using deductions and a variety of other loopholes to pay less tax. It is basically a set of rates that make wealthier taxpayers pay more than lower-income earners. Here’s a basic chart for 2016 to get a better understanding:

Long story short, Trump’s new tax plan states that it will be eliminating this tax altogether. Although the low-income taxpayers label this as controversial, many others are beginning to see the benefits. Over the years, the purpose of the alternative minimum tax has altered; now affected middle-income earners as well as the high-income earners. That wasn’t the original goal so many don’t see the harm in eliminating the tax completely.

Lower the Capital Gains Tax

A taxpayers with a modified AGI of more than $200,000 for single filers and $250,000 for married couples filing jointly has a 3.8% net income investment tax. This is another tax that Trump would like to eliminate completely.

The Inheritance Tax will be repealed.

This tax, known to some as the “death tax”, currently taxes individuals who inherit more than $5.5 million and married couples who inherit more than $11 million at a rate of 40%. Trump plans to remove that 40% tax altogether. So why is this part of the plan so controversial? Many believe that it would deter the wealthy from donating to charities given that the incentive to do so will be no more.

Eliminate numerous tax deductions for individuals

As mentioned earlier, Trump plans to increase the standard deduction amount. Well, surprise! On top of that, he also wants to limit the tax deductions that taxpayers can claim on their return, so limited that you’ll really only be able to claim any that relate to mortgage or charitable donations. This brings me back to our original prediction. Claiming the standard deduction will be the simpler option for many taxpayers if the plan passes.

Change is good…but could it be better?

It’s important that we take a look at these potential modifications with a clear head and (semi) open mind. Trump plans to eliminate a lot from the existing tax plan that we’ve grown to endure over the years. Change is usually followed by even more change. Keep that in mind when filing your taxes for the year. It has to start somewhere.

Tags:

Categories:

3 Responses to “New Tax Plan: Trump’s Six Big Changes”

Leave a Reply

Your email address will not be published. Required fields are marked*

Don’t Miss Any Updates

Sign up with your email to receive latest updates.

admin

admin 3 Comments

3 Comments

Comments(3)

Alison Schweiker

Aug 14, 2017

Hi there! I simply wish to give a huge thumbs up for the nice information you’ve gotten here on this post. I might be coming back to your blog for extra soon.

admin

Aug 15, 2017

Hello Alison,

Thank you for the positive feedback. We are happy that our blogs are helpful.

Moana

Mar 19, 2018

Can I use the new tax reform that president trump made for this year in my previous tax filings?… Since I didn’t file a few of my W2’s during the actual year it was supposed to have been filed, can I use the new tax law for my previous taxes that I haven’t filed yet?