Feb 21, 2014

Feb 21, 2014

If you’re among the 70% of college graduates, the experience abruptly ended upon paying your first student loan payment.

Not only did the world slam you with the pressure to find a job, get your own apartment and pay student loans, but the student loan balance seems to carry some added weight; interest. Well, if you are one of the many Americans paying student loans, there is a bit of good news- when filing your taxes, you can take a student loan interest deduction.

How Much Can I Deduct in Student Loan Interest?

You can deduct up $2500 of interest you paid towards a student loan during the tax year. If you are eligible to claim the student loan interest deduction, you’ll be happy to know that it’s an above the line deduction. That means you aren’t required to itemize your deductions in order to claim the student loan deduction.

Are Student Loans Tax Deductible For Everyone?

In order to claim the tax deduction, you must meet all of the following requirements of the student loan deduction;

- You paid interest on a qualified student loan in the tax year.

- You are legally obligated to pay interest on a qualified student loan.

- Your filing status is NOT married filing separately.

- You and your spouse (if filing jointly), cannot be claimed as dependents by someone else.

- Your modified adjusted gross income (MAGI) is less than the phaseout amount for the tax year.

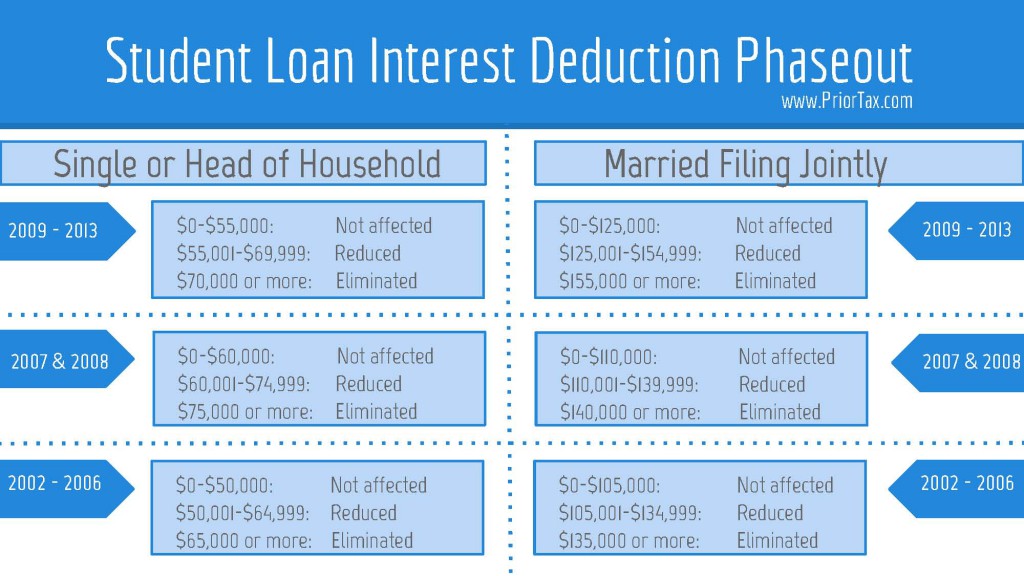

The chart below explains the MAGI student loan interest deduction phaseout for 2013, 2012 and back to 2006. Listed on the chart, the term not affected means your MAGI does not reduce the deduction. Reduced means the maximum deduction allowed will be less than $2500, and eliminated means your income is considered too high to take the deduction.

If you need to file your 2013 taxes or even if you need to still file prior year taxes, you can do so on PriorTax. PriorTax is designed to make tax filing quick and easy for any tax filer, especially those claiming the student loan tax deduction.

Paying student loans can be stressful, but filing your taxes shouldn’t be. File now on PriorTax and use your tax refund towards your next student loan payment (or maybe not)!

2/21/2014 Photo via a.mina on Flickr

Categories:

Leave a Reply

Your email address will not be published. Required fields are marked*

Don’t Miss Any Updates

Sign up with your email to receive latest updates.

admin

admin No Comments

No Comments