Mar 1, 2023

Mar 1, 2023A Quick Overview of Business Meal Tax Deduction for Freelancers and Small Business Owners

For many freelancers and small business owners, there is a common misconception that lunch must include fancy things like white tablecloths and French waitpersons in order to be eligible for a meal tax deduction. This is simply not true.

Consultants and salespeople are just some of the self-employed folks who can claim business lunches. Understanding what is and isn’t acceptable to tax deduct will help you get the most out of meal tax deductions from your expenses. To that end, this guide offers a comprehensive look at what’s allowed when it comes to meals and how to document them properly.

What meal is eligible as a “Business Meal”?

Are you unsure about the definition of a “business meal” regarding tax deductions? Since the Tax Cuts and Jobs Act was passed in 2017, many have been left questioning this topic. Fortunately, there have been no alterations to business meals when deducting them from taxes. The only thing that has changed is that client entertainment expenses, such as concert tickets or golf games, cannot be tax deducted anymore. You can locate your dedicated tax professional to guide you through step by step.

Having discussed the tax deduction process, let’s delve into what exactly constitutes a valid business meal for a tax deduction. According to IRS instruction, “the food and beverages” must be “provided to a current or potential business customer, client, consultant, or similar business contact.” This leaves room for interpretation regarding the term “similar business contact.” To clear up any confusion, let’s review who falls under that category and who does not.

Treating your Clients to Business Meal Luncheon

Lunching with a client can be an excellent opportunity to chat about work topics. While it is polite to pay for the meal, that isn’t strictly necessary. Instead, grab the chance to have a meaningful and productive conversation.

Engaging your Prospective Clients Over a Business Meal

In order to sustain your business, cultivating and preserving your connections is important. For example, alumni from previous jobs and colleagues in relevant industries could all eventually turn into possible buyers – or point you toward one.

When it comes to enticing a prospective client, there is no need for the lunch meeting to be concluded with paperwork or a signed agreement.

Business Meals with Colleagues and Coworkers

Getting together for a bite to eat with someone in your field can benefit entrepreneurs. Not only is it an opportunity to network with business prospects, but you can also discuss industry updates and learn about the newest trends in your business. Plus, it’s all tax deductible.

Business Meal Over a Meeting with a Potential Referral

Networking for referrals can be rewarding in many ways. Freelance work platforms such as Upwork, Uber, and others may offer up to $500 per referral, a great financial incentive.

Moreover, grabbing lunch or coffee with someone who could be interested in your referral program can be considered a tax deduction.

Business Meal for a Networking Opportunity with Anyone

Networking with the right individuals is essential for your business’s success. With that in mind, it’s important to ensure that you stay informed about the latest industry news and developments. In addition, connecting with other professionals to gain insight or exchange advice can greatly expand your reach. Remember, many people get referrals from those they have existing relationships with – so take advantage of this opportunity! This could be someone you know personally, such as friends, family members, or even neighbors.

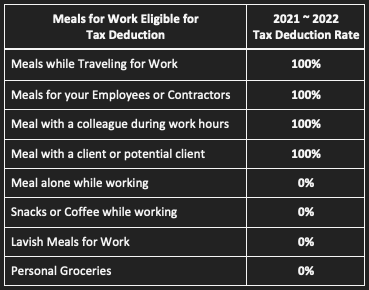

Which Meals are not Considered Business Expenses and Meal Tax Deduction?

It’s important to be aware of the types of food that cannot be claimed as a tax deduction. Here are some examples that may come as a surprise. Unfortunately, these purchases are not allowed deductions even though they seem like they should be.

Nibbling on Snacks During Work

Generally speaking, any food consumed while employed that is not required for your job is not tax-deductible. For example, imagine you are a security guard contracted on a 1099 and unable to move from your post for the full day – those snacks would be eligible for a deduction. However, with the average busy professional just trying to save time between meetings, these items should be considered personal expenses.

Buying Up Groceries for your Home Office

Outfitting a home office does not necessarily mean you can write off the groceries on your tax return. Unfortunately, the chances of deducting grocery expenses from your taxes are slim to none.

Eating Alone During Business Hours

Even though you may be taking a break from the office to grab a bite to eat, eating alone doesn’t necessarily qualify as an expense that can be deducted. This goes for any solo purchase, even buying coffee while working away from the office at a cafe.

Temporary 100% Tax Deduction for Business Meals at Restaurants

Ready to wine and dine with your clients? Here’s one special consideration to remember: In the 2022 tax year, any business meals you get at restaurants are 100% tax-deductible.

Everyone’s calling this the “three-martini lunch” tax break. It’s actually part of the Consolidated Appropriations Act of 2021, which bundled together a number of COVID relief measures. The thinking was this tax break would help restaurants gutted by the pandemic. Before, business meal deductions were capped at 50%.

Tags:

Categories:

Leave a Reply

Your email address will not be published. Required fields are marked*

Don’t Miss Any Updates

Sign up with your email to receive latest updates.

admin

admin No Comments

No Comments