Nov 13, 2015

Nov 13, 2015

Filing your first tax return is a bit like doing your laundry.

You don’t want to do it. You’d prefer someone just did it for you. But if you don’t do it, you know there will be consequences.

Unlike laundry, you’ll need to do a bit more sorting, as in sorting through of all those tax forms. And unlike laundry, you really should know the basics before you start. Don’t worry though: you’ll get through it and probably even get a refund afterwards.

Find out if you are being claimed as a dependent!

The first thing you should do is talk to your parents. Since they’ve been claiming you as a dependent since before you could even utter the words, ‘tax return’, make sure they know you are planning on filing for yourself to avoid being rejected by the IRS. Each and every person is allowed to claim a personal exemption for themselves or their dependent. However, only one exemption can be claimed per person.

Here’s a classic scenario:

Abby was just hired as a barista at that awesome new cafe downtown. She makes a decent income and her co-worker mentions that she could probably cash in on a nice refund come tax time. Being that Abby is only 17 and earning less than the threshold allotted by the IRS, her parents can still claim her as a dependent on their return. If Abby files a tax return and claims the personal exemption for herself, not noting that she is being claimed as a dependent, and then her parents claim the personal exemption for Abby on their return, the IRS will reject the last tax return submitted.

Do you know the age requirements to be claimed as a dependent?

Although your age doesn’t specifically determine if you need to file a tax return, it is a key player in whether or not you can be claimed as a dependent on someone else’s taxes. When it comes to age, you can only be claimed as a qualifying child dependent if one of the following is true:

- you are under the age of 19

- you are under the age of 24 and a full-time student

*Please note that if you are disabled, you can be claimed as a dependent at any age.

How about the type of income you earned?

Whether or not you need to file a tax return is based on your income type and income amount. Generally speaking, there are two types of income you should pay attention to:

- Employee income: what you earn and see on your W-2 form at the end of the year

- Self-employment income: what you earn and see on your 1099 at the end of the year

When it comes to how much income you are earning, pay attention. This can get tricky. If you’re not claimed as a dependent anymore, are under age 65 and answer YES to any of the following questions, then you’ll need to file a tax return:

- Are you self-employed and earn at least $400 net income per year?

- Are you single with an earned gross income of $10,150 or more per year?

- Are you married filing a joint tax return with a gross income of $20,300 or more per year?

- Are you married filing separate returns with a gross income of $3,950 per year?

- Are you head of household with a gross income of $13,050 per year?

- Are you a widow(er) with a gross income of $16,100 per year?

*Keep in mind that these income amounts are subject to change each year.

Understand how to complete your W-4!

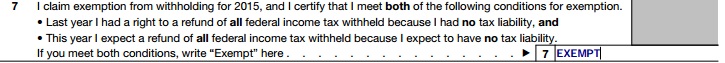

If you’re no longer claimed as a dependent, you’ll need to remove EXEMPT from line 7 of your W-4 form.

Never claimed exempt? Still consider updating your W-4. Taxpayers tend to fill out their W-4 however they are advised to, without really understanding how it works. I have a whole article that explains it in depth here. For the sake of saving you a massive headache, here are some basic rules to keep in mind:

- Claim less allowances if you want more income withheld from your paychecks. This means you will have less tax due to the IRS (or a higher refund) after filing.

- Claim more allowances if you want less income withheld from your paychecks. This means you will have more tax due to the IRS (or a smaller refund) after filing.

- Claiming zero allowances causes the maximum amount to be withheld from your paychecks and will result in the highest refund possible.

Get to know the tax deadlines!

Everything in life eventually comes to an end, including the tax year. With taxes, you have specific deadlines that you need to meet in order to avoid IRS penalty fees. Just to touch base on a few:

- April 15th. This is the tax return deadline. It is hands down the most important date for you to remember. It is the last day to submit your tax return to the IRS before it is considered late and starts to accumulate late penalty fees. It is also the last day that you can file for a tax extension.

- October 15th. This is the tax extension deadline. It is also the last day that you can e-file a tax return to the IRS. After this date, the IRS will still accept returns but you will need to print, sign and mail them.

- January. This isn’t an actual ‘deadline’ but still an important time. This is the month when you can begin submitting your tax returns to the IRS. Keep an ear out. The IRS changes it up each year but will always announce the exact date.

Have you thought about where you should file?

Let’s face it. The two main reasons taxpayers file at all are:

- It’s the law.

- They are getting a refund from the IRS.

You want peace-of-mind when filing your tax return.That being said, you should also keep in mind the price you will be paying to actually prepare and file your tax return for the year. You’re new to this so I want to provide a brief run-down of the options you have available:

- Do it yourself. DIY might be fun when it comes to your Pinterest boards but when taxes are involved, it’s going to involve more than mod podge and a creative touch.

- Use an accountant. This is the closest you’ll get to your parents doing it for you plus a chunk out of your wallet. Consider this option a very expensive security blanket.

- Purchase software. I would say this option is for all the ‘lazy professionals’ out there. In other words, you know how to complete a tax form. You just don’t really feel like it.

- Use online tax preparation. This is best if you want some sort of guidance for a reasonable price. This is the way to go with a basic tax return. In fact, with PriorTax, you’ll have free customer service via phone, email and live-chat.

Want to know more?

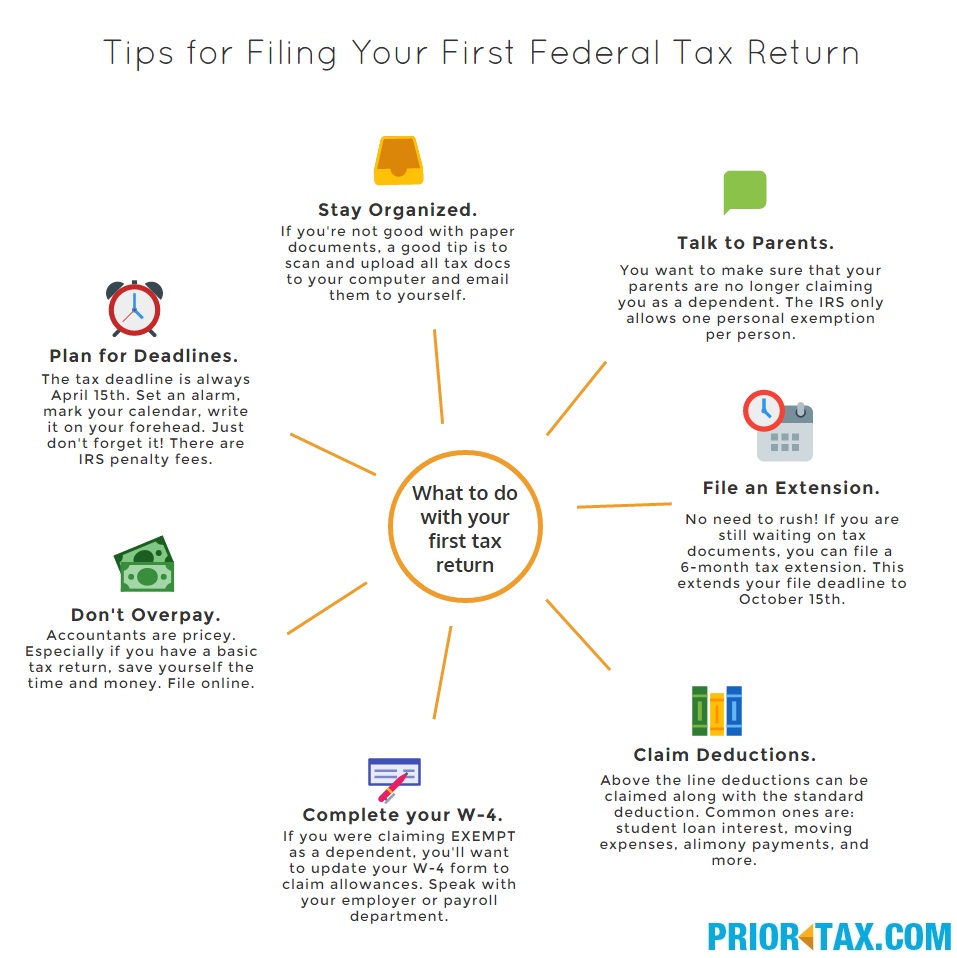

Feel free to save the image below to keep with your tax documents.

Tags:

Categories:

Leave a Reply

Your email address will not be published. Required fields are marked*

Don’t Miss Any Updates

Sign up with your email to receive latest updates.

Michelle O'Brien

Michelle O'Brien No Comments

No Comments