Feb 19, 2016

Feb 19, 2016

Fashionably late? You can still file your 2012 tax return!

Unfortunately, filing your tax return late isn’t as notable as arriving an hour later than planned to a cocktail party. However, the IRS does give you three years to claim your refund after the official April deadline.

Use our 2012 tax calculator to figure out how much the IRS owes you (or what you owe them).

What information do I need for the 2012 tax calculator?

To use our calculator tool, you just need some of your basic tax information from 2012. You’ll be able to navigate different tabs as shown below.

Complete each section as best you can. Although it is best to complete every section entirely, you can skip the credits and deductions tab if you’re unsure. This will give you a ballpark figure until you have the time to gather your paperwork.

Some basics that you’ll want to have handy are your:

- Family info including filing status, how many dependents you’re claiming, etc.

- Income info including wages, investments, business income, etc.

- Deduction and Credit info including mortgage and alimony payments, medical and employee expenses, donations, tuition fees, retirement contributions, etc.

Make sure to click ‘Continue’ after each tab is complete and watch your tax amount change right before your eyes!

How much will my 2012 tax refund be?

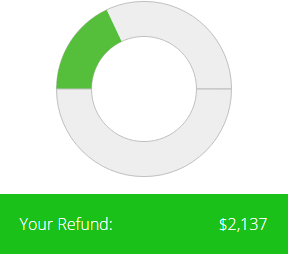

After completing each tab of the calculator tool, you’re refund amount will update accordingly. For example, once you enter your W-2 income and your federal withholding, your refund amount might look something like this:

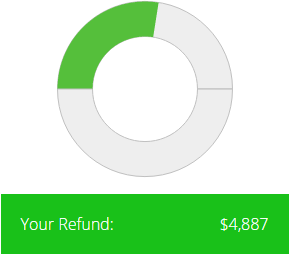

Then, when you begin to enter your expenses under the Deductions and Credits tab, your refund may increase, causing you to see something like this:

What if I owe the IRS for 2012?

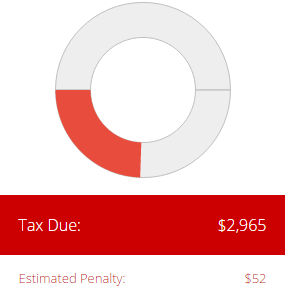

For those of us who owe tax instead of being issued a refund, don’t worry. You can still file. You might just need to pay a penalty fee to the IRS with your tax due. After entering your information into our calculator tool, we’ll show you your tax due amount along with the estimated penalty fee. It will look something like this:

Even if you owe the IRS, there are credits you can claim. And the good thing about credits are that they lower your tax due amount dollar for dollar! Reach out to our tax team for help with which credits you qualify for.

Now let’s prepare that 2012 tax return!

Whether you owe taxes or are expecting a refund from the IRS, it’s better to file your 2012 tax return now than to procrastinate any longer. Prepare and postmark your 2012 tax return by April 18, 2016 to get your refund. After using our tax calculator, you can create an account on PriorTax.com and get your 2012 tax return out of the way.

Tags:

Categories:

2 Responses to “How To Calculate Your 2012 Tax Refund”

Leave a Reply

Your email address will not be published. Required fields are marked*

Don’t Miss Any Updates

Sign up with your email to receive latest updates.

Michelle O'Brien

Michelle O'Brien 2 Comments

2 Comments

Comments(2)

Cindy Brown

Mar 21, 2017

Can i file 2011 or is it to late? The IRS is holding my 2016 taxes until i file 2011 & 2012 taxes. I didnt think i made enough to mess with filing those years , but i guess i did. I cannot find my W2s. HELP

admin

Mar 29, 2017

You can file your Prior year 2011 tax return at http://www.priortax.com Simply select the tax year as 2011 then enter a username and password. This will create a 2011 account for you. The next step is to enter your information. If you do not have your income statements, you can contact your past employer to obtain a copy, or you can request a transcript of your income online from the IRS here or fax form 4506-T to the IRS.

Once you have obtained your information, you can complete the data entry process in order to prepare your 2011 return. Once prepared, you simply print, sign and mail your return into the IRS.