Oct 28, 2014

Oct 28, 2014

After April 15, 2015, you’ll no longer be able to claim your 2011 Tax Refund

Mark your calendar- April 15, 2015 is not only the deadline to file your 2014 tax return, it’s also the last day you’ll be able to file your 2011 tax return and receive your 2011 refund.

The statute of limitations only allows tax filers three years to claim a tax refund.

So where does the unclaimed money go after the three year period has passed? You guessed it- the IRS keeps it.

Don’t hand over your money to the government, file your 2011 tax return today and claim your refund before it’s too late!

How To File Your 2011 Taxes

It’s not yet the 2011 tax return deadline to claim your refund money. That means, you can complete your tax return today and wait for your refund check from the IRS. Here’s how;

- Create a PriorTax account: Select 2011 from the “Tax Year” drop down menu and enter your desired username and password.

- Enter Your Information: Fill in your basic information and tax information corresponding with the 2011 tax year.

- Submit your account: After submitting, the PriorTax team will review your information, prepare your return and upload it to your account.

- Mail your return: After your return is ready for download, you’ll print, sign and mail it to the IRS.

- Wait for your refund: You’ll have to wait 4-8 weeks for your refund check from the IRS, but you’ll have peace at mind knowing your tax return is complete!

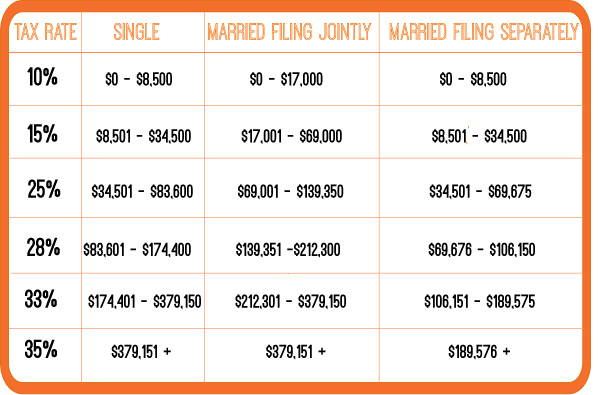

2011 Tax Rates to Keep In Mind

Before you start your 2011 return, you may need to be refreshed on the 2011 tax rates (after all, it’s been a couple years). Below, are the 2011 rates

Get started on your 2011 Tax Return!

Why put it off any longer? If you wait much longer you won’t be able to claim your tax refund! Get it out of the way today and collect your refund money.

As always, the PriorTax team is available to help answer any tax questions you may have. Call, chat or email us!

Photo via eFile989 on Flickr

Categories:

2 Responses to “April 15, 2015 is the Last Day to Claim Your 2011 Tax Refund”

Leave a Reply

Your email address will not be published. Required fields are marked*

Don’t Miss Any Updates

Sign up with your email to receive latest updates.

admin

admin 2 Comments

2 Comments

Comments(2)

martin rivera and reyna rivera

Dec 13, 2014

I would like info about my 2011 year tax refund since i can get any info from the where is my refund

admin

Dec 18, 2014

Hi Martin and Reyna,

If you are unable to receive any information from the IRS “Where’s my Refund” tool, then I suggest contacting the IRS office or your local IRS office.