Feb 9, 2022

Feb 9, 2022Complete Guide to Tax Brackets 2021

As 2021 draws to a close and we look back at the year that’s been, let’s take a moment now to look at what the 2021 tax brackets mean for you and the money you earned over the past year.

What are tax brackets, and what are they used for?

There are seven federal tax brackets by the IRS to determine how much federal income tax you owe on any income you earned during the year. Each bracket corresponds to a percentage rate: 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

The U.S. federal income tax system is a progressive tax system. This means that you are subject to higher federal income tax rates when you have higher taxable income. But, equally, you are subject to lower federal income tax rates when you have lower taxable income.

Calculating how much tax you owe will get complicated. How much tax you owe depends on which tax brackets for 2021 your total taxable income will fall into. Rather than finding the bracket and paying the corresponding tax rate on your entire taxable income, your taxable income is divided across all applicable brackets. Each subdivision is then taxed at the corresponding tax rate.

Why are there 2021-specific tax brackets?

Ahead of each tax year, the IRS publishes updated income ranges corresponding to each tax rate. This is to take into account inflation rates and is part of the wider inflation adjustments the IRS makes annually to sixty plus different tax provisions.

These adjustments are announced during the final quarter of the preceding year. For example, the changes for the current tax year, including the tax brackets, were announced on October 26, 2020. Taxpayers and tax professionals then use this information for taxes due in April 2022 (or in October 2022, when a filing extension has been requested).

What information do I need to read the 2021 tax brackets?

When looking at the 2021 tax brackets, you will need to know your total taxable income in 2021 and your filing status. Your total taxable income refers to the part of your gross income for the year that is subject to taxation. It will depend on your income tax filing status, the type of income you had, and your financial activity over the course of the year.

All U.S. taxpayers fall into one of five different filing statuses. The IRS uses this to determine your filing requirements, possible deductions and/or credits, and your tax rate. In determining your filing status, your marital status, your spouse’s year of death (if a widow/widower), and the contribution toward household expenses from members of your household. The IRS offers an online interactive tax assistant, “What Is My Filing Status?” on their website to help you figure out your filing status.

You will use these two pieces of information to identify where amongst the tax brackets your financial situation falls and what that means for your tax rate when it comes time to file your tax return.

With these details laid out, let’s take a look at what the tax brackets mean for each filing status and how you can use this information. Looking at the table for your filing status, identify the row corresponding to your taxable income range to determine how much tax you will owe.

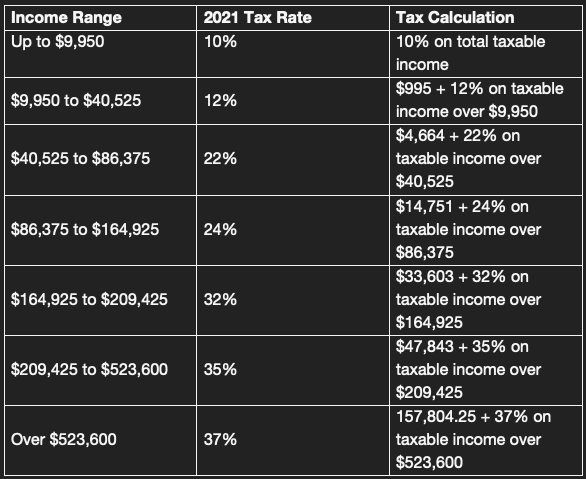

Single Filers:

What do the 2021 tax brackets tell us about calculating the tax owed for single filers?

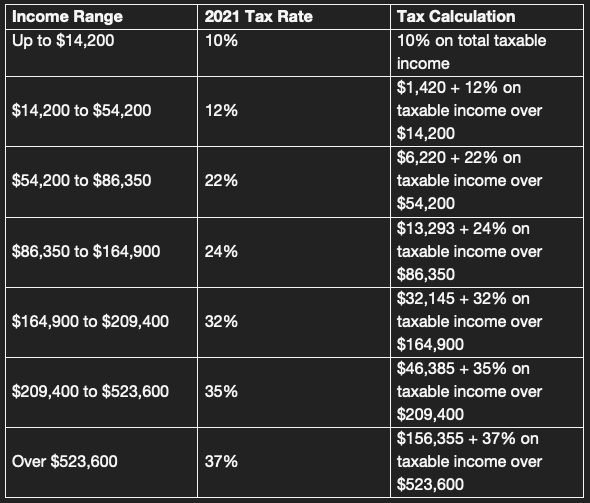

Head of Household Filers:

What do the 2021 tax brackets tell us about calculating the tax owed for people filing as head of household?

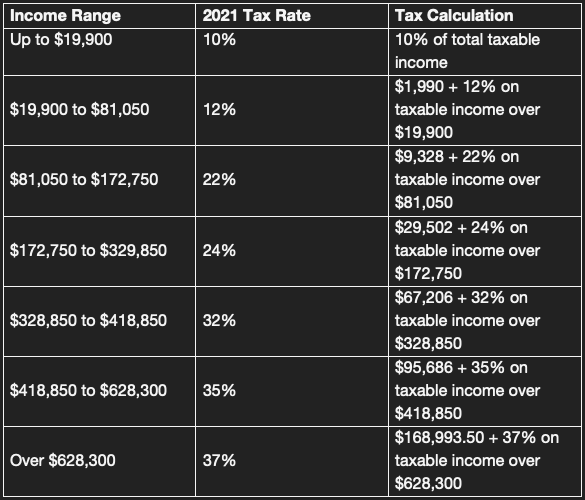

Married Filers, filing jointly:

What do the 2021 tax brackets tell us about calculating the tax owed for married couples filing jointly?

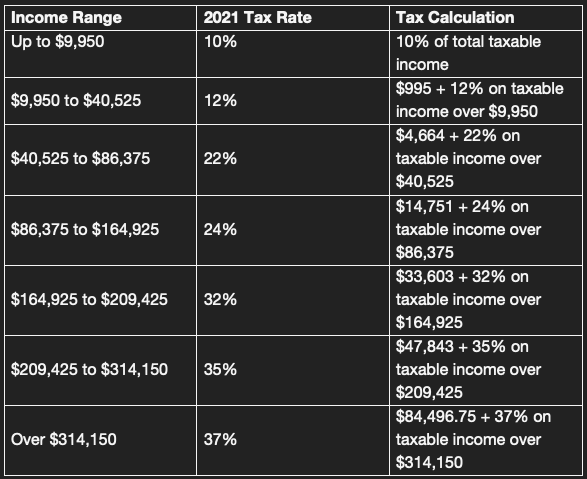

Married Filers, filing separately:

What do the tax brackets for 21 tell us about calculating the tax owed for married couples filing separately?

Looking for more tax tips to prepare you for the 2022 tax season? Then look no further than PriorTax.com. Visit today to keep up to date with important tax news. Learn more about our full range of tax filing services. PriorTax.com provides Free Tax Advice and have CPA or Professional Reviews available for certificate. Also check out our state of the art free Tax Calculator

We offer both prior year and current year tax filing services to help you keep on top of your income tax obligations past and present.

Tags:

Categories:

Leave a Reply

Your email address will not be published. Required fields are marked*

Don’t Miss Any Updates

Sign up with your email to receive latest updates.

admin

admin No Comments

No Comments