Dec 24, 2018

Dec 24, 2018

The IRS finally released the new 2018 tax return.

You’ll see some obvious changes in the new tax return. But first, here’s a breakdown of how to report your tax information.

Keep reading to find out how filing this upcoming tax season will be different.

Introducing Schedules 1 – 6

Form 1040 will be shorter than the previous form because the IRS consolidated tax information into separate schedules. That being said, all additional income and adjustments to income have moved to Schedule 1, taxes moved to Schedule 2, nonrefundable credits moved to Schedule 3, other taxes moved to Schedule 4, other payments and refundable credits moved to Schedule 5, and foreign addresses/third party designee’s moved to Schedule 6.

Here’s how you will be reporting this information.

| Schedule | Type of Tax Information |

|---|---|

| Schedule 1 | Additional income such as capital gains, unemployment, gambling winnings, prize/award money, deductions such as the student loan interest deduction, self-employment tax and educator expenses |

| Schedule 2 | You owe AMT or you need to make an excess advance premium tax credit repayment |

| Schedule 3 | Nonrefundable credits such as the credit for child and dependent care expenses, foreign tax credit, education credit, or the general business credit |

| Schedule 4 | Other taxes as self-employment taxes, household employment taxes, additional tax on IRAS, other qualified retirement plans/tax-favored accounts |

| Schedule 5 | Specific refundable credits such as the net premium tax credit, health coverage tax credit, other payments like paying an amount towards your extension to file or an excess of social security withheld |

| Schedule 6 | Foreign addresses or third parties other than a paid preparer |

Changes to the 2018 tax law

As a reminder, Form 1040 not only changes, but so do our tax laws. Now, here’s a refresher of what was changed under the Tax Cuts and Jobs Act (TCJA).

- Forms 1040A and 1040-EZ are no longer available to file your 2018 taxes

- The tax rates are now 10%, 12%, 22%, 24%, 32%, 35%, and 37%

- You cannot claim personal exemptions

- The standard deductions doubles

Single filers – $12,000

Joint filers – $24,000

Head of Household filers – $18,000 - Itemized deductions are limited

- Social security numbers are mandatory to claim the Child Tax Credit (CTC)

- The maximum CTC increases to $2,000 and the Additional Child Tax Credit increases to $1,400

The phase-out threshold for these credits increases to $200,000 for single filers, $400,000 for joint filers - Eligible dependents who don’t qualify for the CTC receive a credit of up to $500

- You can deduct 20% of your qualified business income

- April 15, 2019 is the tax deadline unless you live in Maine or Massachusetts which you then have until April 17 for Patriots’ Day

Click here to read more about the tax changes next year.

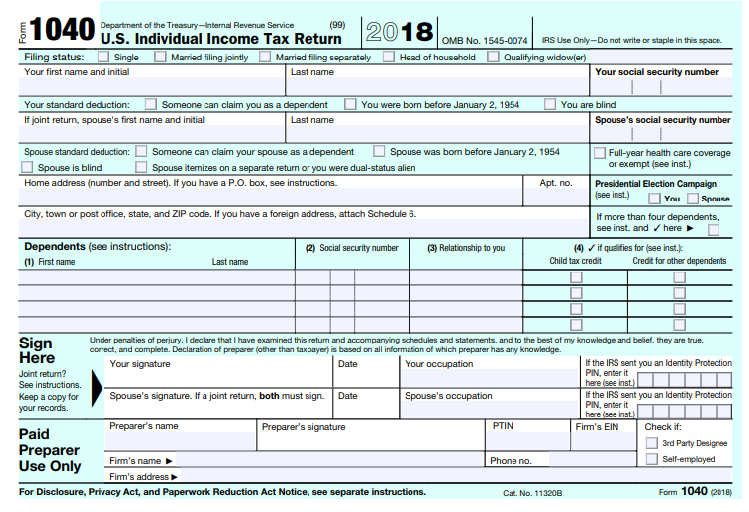

Take a look at the first two pages of Form 1040:

Right off the bat, you may notice that the first page looks like its been cut in half. Prior to this, personal exemptions (Lines 6a – 6d), Wages (Line 7) to Adjusted gross income (Line 37) was on the fist page of Form 1040. However, because of the elimination of personal exemptions and the introduction to Schedules, the bottom portion of Form 1040 page 2 moves to the first page.

Therefore, the first page would solely be personal information and your dependents.

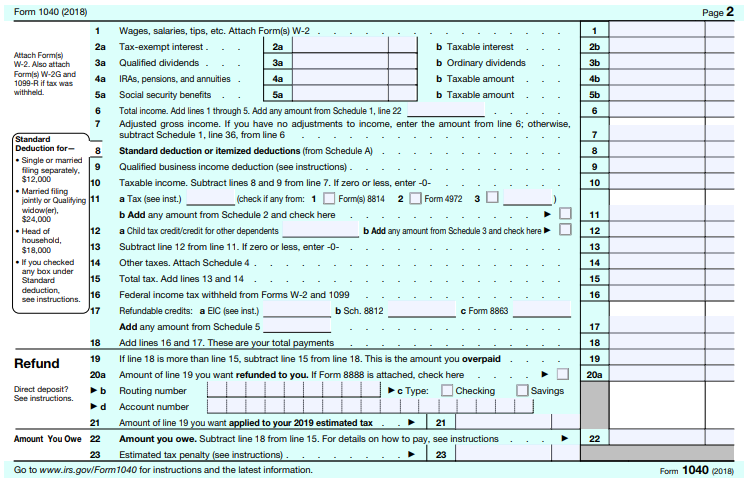

Even with the postcard-like first page, page 2 is just as small. Since there are only 23 lines, you can see how much of a difference each schedule makes.

Start preparing your tax return.

You can start on your 2018 tax return before the tax season starts on January 28, 2019 with PriorTax! All you need to do is create a 2018 account once the tax application is ready to go. Don’t forget to file any back taxes just in case you’re getting a refund this tax season!

Tags:

Categories:

5 Responses to “Instructions for Filing the New 2018 Form 1040!”

Leave a Reply

Your email address will not be published. Required fields are marked*

Don’t Miss Any Updates

Sign up with your email to receive latest updates.

Manisha Hansraj

Manisha Hansraj 5 Comments

5 Comments

Comments(5)

Marni Gangluff

Mar 2, 2019

Hello! I just would like to give a huge thumbs up for the great info you have here on this post. I will be coming back to your blog for more soon.

William Horton

Mar 21, 2019

Why does the first page ask if I had full year health coverage?

Thanks.

Manisha Hansraj

Mar 29, 2019

The first page of the 1040 has a box to indicate to the IRS whether or not you were covered for the full year by your health insurance. Unless you were exempt, you are subject to the individual mandate penalty for not having health insurance for the months you weren’t covered.

Anne Driscoll

Apr 14, 2019

Do I need to include all of my 1099 forms?

Manisha Hansraj

Apr 23, 2019

Hello Anne,

You should report all of your 1099 forms to ensure that your tax return is accurate and complete. All taxable income must be reported.