Feb 17, 2016

Feb 17, 2016

“Why should we look to the past in order to prepare for the future? Because there is nowhere else to look.”

Although this is a quote by a historian who probably knew little about filing a tax return, it is oddly relatable when trying to locate a prior year AGI. Here’s why. In order to find your AGI (otherwise known as adjusted gross income), you’ll need to take a look at the prior year’s tax documents. I’ve pinpointed three easy ways to find your prior year AGI without having to dig too deep into the past. Let’s take a look.

1. Your tax return

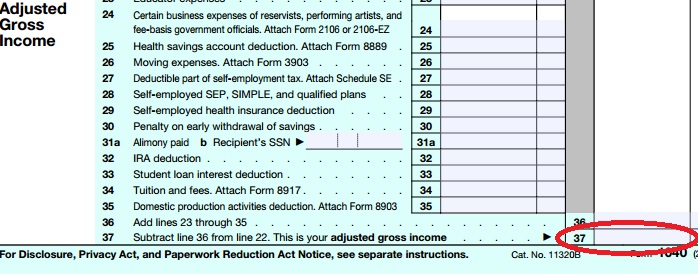

If you’re the type of person who has a knack for keeping track of important paperwork, then you probably know where to find your tax return from last year. Once you find it, you’ll be able to find your AGI amount for the year on line 37 of Form 1040, as you’ll see below.

*Did you file a 1040EZ last year? Your AGI will be on line 4. On a 1040a, your AGI will be on line 21.

If you can’t find your tax return from that year, it doesn’t mean you’re unorganized. It could just mean that you e-filed your tax return that year instead of printing out a copy to mail to the IRS. This brings me to your second option.

2. A transcript from the IRS

This takes a little longer but is completely free. If you click the button below, you’ll be directed right to the IRS website where you can request a transcript.

Here’s a list of some information you’ll want to have handy:

- your SSN

- your DOB

- your address currently on file with the IRS

- your zip code currently on file with the IRS

3. Your tax preparer

Did you prepare your tax return with us within the past three years? If you did, then you can log into your account with the username and password you created. Once you’re logged in, you’ll still have access to your printable tax return which will list your AGI on line 37 of the 1040. If you have any trouble logging in, give our tax team a call and we’ll help you get the information you need.

Didn’t file last year?

It happens. At least you’re catching up this year, right? If you didn’t file for the year you need to find your AGI for, enter zero. You’ll also need to do this if you paper filed instead of filing electronically.

Once you find your AGI one way or another, you’ll be able to get down to business can prepare your tax return. You can create an account with PriorTax and file all of your returns dating back to 2005.

Tags:

Categories:

15 Responses to “Where To Find Your Prior Year AGI”

Leave a Reply

Your email address will not be published. Required fields are marked*

Don’t Miss Any Updates

Sign up with your email to receive latest updates.

Michelle O'Brien

Michelle O'Brien 15 Comments

15 Comments

Comments(15)

Sharon L Jones

Mar 28, 2017

I have misplaced my papers from last year.(2015) I filed taxes and received my refund. Do I need the figures from those

papers to files my 2016 taxes?

admin

Mar 29, 2017

If you are looking to e-file your 2016 return, you may need to provide your prior year AGI(adjusted gross income) from your 2015 return to serve as your electronic signature on your 2016 return. If you do not have your prior year AGI, you can choose to e-file your return with your prior year PIN.

Generally, you do not need your 2015 return to prepare your 2016 return, except in cases where you have a NOL (net operating loss) in 2015 that you would like to carry over to 2016.

Matthew Nowling

Feb 16, 2018

Please send me my AGI number. I have everything else done just have to have that number please. Its AGI number from 2016. Thank u Matthew Nowling

admin

Apr 2, 2018

Matthew,

In order to locate your prior year AGI, contact your tax preparer, get a copy of your tax return and locate it on line 37 of Form 1040 or contact the IRS for a transcript.

keyonia breland

Mar 4, 2018

can not find AGI from prior year tax return? what can i do?

Manisha Hansraj

Mar 16, 2018

Hello Keyonia,

On your individual income tax return, line 37 is your adjusted gross income. If you are having difficulty and have an account with us, feel free to give us a call.

Mary E Manoogian

Mar 7, 2018

I cant retrieve my 2016 tax return to get my AGI from 2016. I really need help.

admin

Mar 29, 2018

Hello Mary,

If you filed with us for 2016 you can contact us by phone at (877) 289-7580 during our hours of business Monday-Friday, 10am-5pm EST for a PDF of your prior year return. If you did not file with us, you can use the IRS Get Transcript Online tool to immediately view your Prior Year AGI or contact the IRS at 1-800-829-1040.

2016 AGI

Mar 7, 2018

In order to file electronically for this year’s taxes I need to find the 2016 AGI. I do not have possession of 2016 tax papers, how can I get that information?

Janet Studer

admin

Apr 2, 2018

In order to locate your prior year AGI without a copy of your prior year tax return, contact the tax company or preparer to provide you a copy or contact the IRS to request a transcript over the phone or on the IRS website.

Lenora Cochran

Mar 18, 2018

trying to find the amount on line 37 from my 2016 taxes

admin

Mar 23, 2018

Hello Lenora,

In order to get your prior AGI you may use the IRS Get Transcript Online tool to immediately view your Prior Year AGI or contact the IRS toll free at 1-800-829-1040. If you filed with PriorTax last year, you may also reach us for a PDF copy of your return.

Reginald s jones

Mar 24, 2018

I need my AGI number so I can try file my tax

admin

Mar 28, 2018

Either contacting the company that you previously filed with for a copy of your 2016 return or getting in touch with the IRS for a tax transcript, will provide you with this information. If you would like to reach out to the IRS for a transcript, please follow the instructions provided by their Get Transcript section of the website.

admin

Mar 29, 2018

Hello Reginald,

If you filed with PriorTax for the prior year tax return you can us by phone at (877) 289-7580 during our hours of business Monday-Friday, 10am-5pm EST or use the IRS Get Transcript Online tool to immediately view your Prior Year AGI as well as contact the IRS toll-free at 1-800-829-1040.