Feb 17, 2015

Feb 17, 2015

File your late 2011 taxes in 2015 with PriorTax. If not, IRS late fees will continue to grow.

Sometimes it seems easier to put off doing something rather than actually doing it…. Well, atleast that’s what we tell ourselves.

When it comes to preparing taxes, this often seems to be the case. After all, you have other things to do.

Although it’s tempting to leave your 2011 taxes on the back-burner, it’s a better idea to get it done with.

Here’s why you’ll want to file your late 2011 Tax Return ASAP;

- the very last day you’ll be able to claim a 2011 refund is April 15, 2015

- if instead, you owe the IRS tax on your 2011 taxes, your late fees continue to increase as time passes

The good news is you won’t have to prepare your 2011 taxes alone. In fact, you can file 2011 taxes in 2015 online with PriorTax!

Don’t put it off any longer- filing 2011 taxes doesn’t have to be complicated. Simply create a PriorTax account and follow the provided steps below.

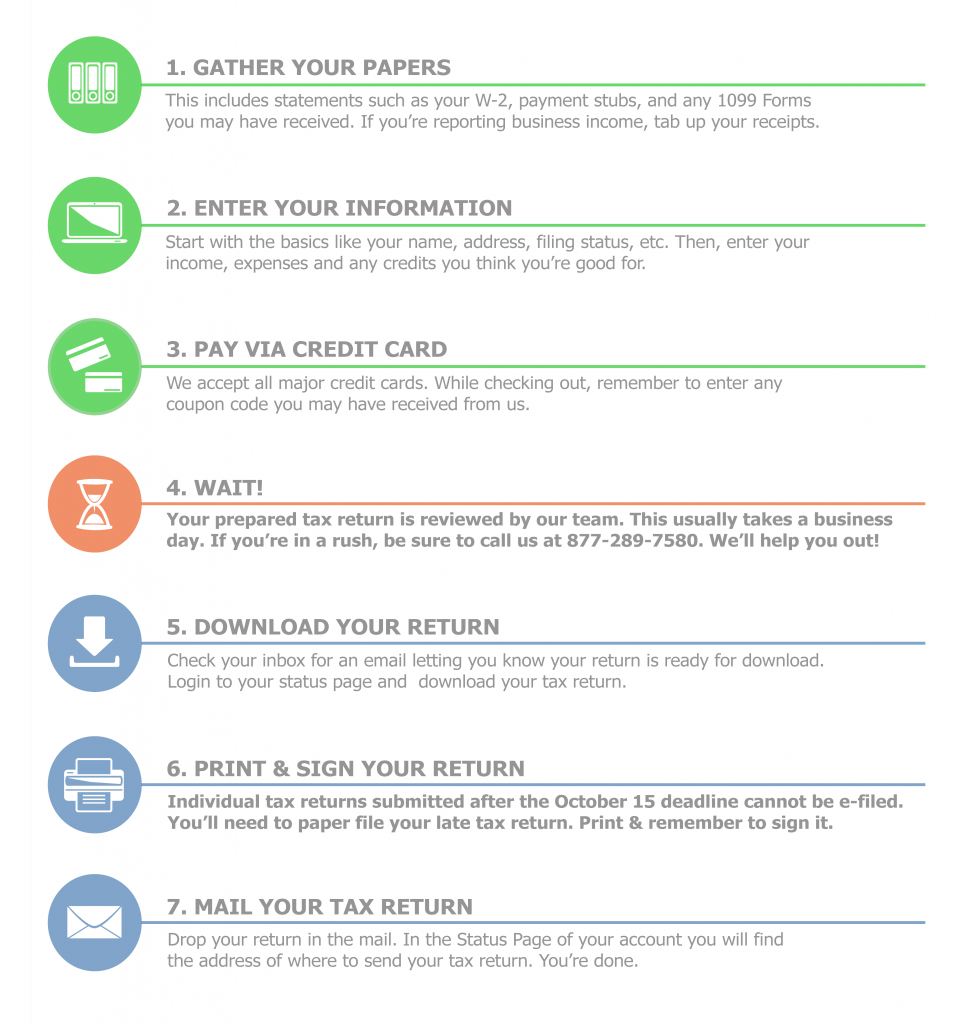

7 Steps to File 2011 Taxes in 2015

Once you’ve created an account on PriorTax, follow these seven steps to file your 2011 tax return:

Can I Still Get My 2011 Tax Refund?

If you’re expecting to receive a refund from your 2011 taxes, you won’t have to pay any late penalties or interest for filing late. However, you should definitely keep in mind that the very last day you can claim your 2011 refund is April 15, 2015. After this date, the three year statute of limitation is up and the money officially belongs to Uncle Sam.

If the opposite is true and instead, you owe the IRS, plan on facing late penalties, including:

- Failure-to-file: 5% of your tax due total for each month your return is filed late, up to 25%

- Failure-to-pay: ½ of 1% of your unpaid taxes for each month or part of a month left unpaid (this amount is waived if you’re already facing the failure-to-file penalty)

So what are you waiting for? Get your 2011 taxes out of the way now! If you have any questions while filing your late tax return with PriorTax, our tax experts are available via phone, live chat and email to help you.

Photo via Sebastian Oliva on Flickr

Categories:

Leave a Reply

Your email address will not be published. Required fields are marked*

Don’t Miss Any Updates

Sign up with your email to receive latest updates.

admin

admin No Comments

No Comments