Sep 26, 2014

Sep 26, 2014

Save this page to refer back to once you file your 2014 Tax Return!

It’s never to soon to start thinking ahead to the upcoming tax season. After all, you may be wondering when you can expect to receive your 2014 tax refund money!

In the past, the IRS posted a refund cycle chart, allowing tax filers to learn exactly when they would receive their tax refund.

Unfortunately, the IRS no longer provides the refund cycle dates. Instead, allow filers to track their refund with the IRS “Where’s My Refund?” tool.

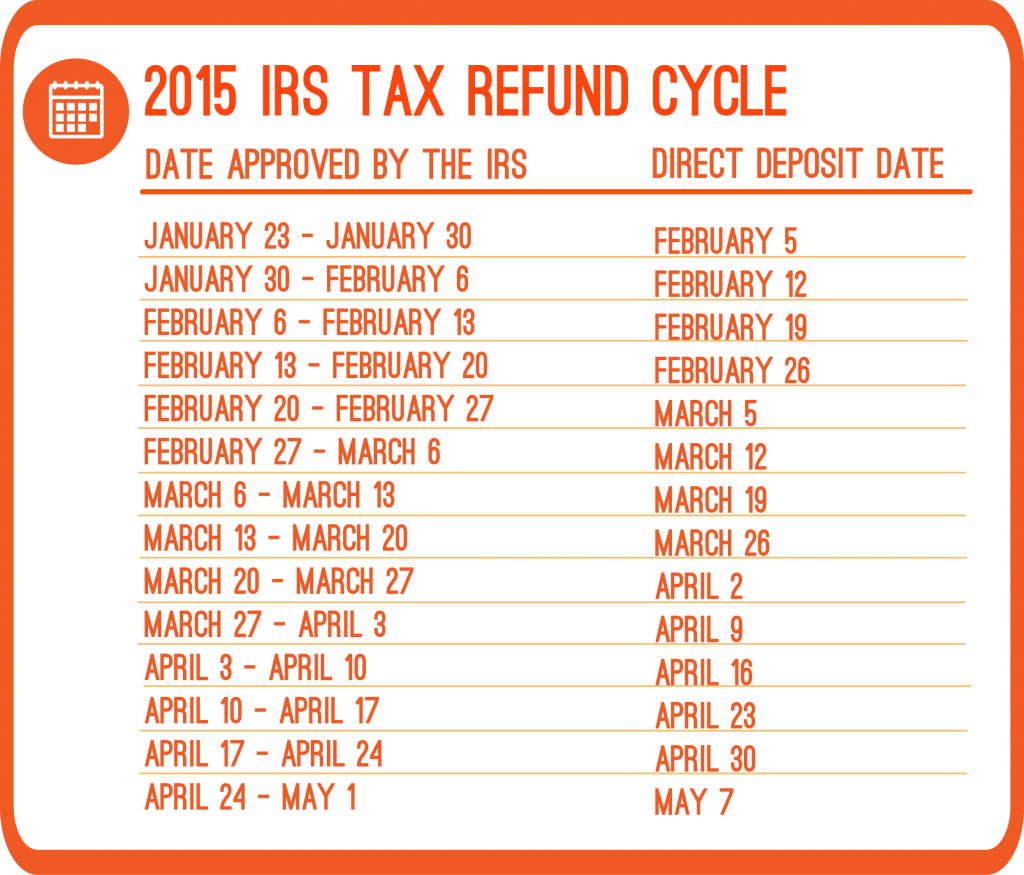

This change may have been a disappointment to you. We want to help. Below, you’ll find a PriorTax estimate 2015 refund cycle chart.

Track Your Refund on the IRS Site

In addition to using the chart provided below, after filing your 2014 tax return, you’ll be able to track your 2014 tax refund using the IRS “Where’s My Refund?” tool.

The IRS site will give you a status update on the whereabouts of your tax refund after you’ve entered the following information;

- social security number

- filing status

- refund amount

You’ll also be happy to hear you can use this tool to track your late 2013 tax return.

2015 Refund Cycle Dates

Note: The refund cycle dates below are NOT definite. They are only expected dates, based off of previous year trends.

Get Ready for the 2015 Tax Season

You’ll have to wait until the beginning of 2015 to file your 2014 tax return and receive your 2014 tax refund. However, you may find it helpful to bookmark this page to refer back to once tax season arrives. At that point you’ll get a better idea on when can expect to receive your tax refund!

Until the 2015 tax season begins, you can get caught up on your prior year tax returns with PriorTax!

The PriorTax team is available to answer any refund or tax return questions you may have before, during or after filing your tax return.

Photo via Chris Potter on Flickr

Categories:

6 Responses to “What are the 2015 Refund Cycle Dates?”

Leave a Reply

Your email address will not be published. Required fields are marked*

Don’t Miss Any Updates

Sign up with your email to receive latest updates.

admin

admin 6 Comments

6 Comments

Comments(6)

schell chaudoin

Feb 5, 2015

totaly incorrect on the cycles part. the IRS started accepting refunds on the 14th

admin

Feb 11, 2015

Hi Schell,

As stated in the article, these dates are estimated based on prior year refund cycle dates. They are only to give tax payers an approximate date for when they may receive their refund.

frddie & nancy wolfe

Feb 10, 2017

I NEED A COPY OF OUR TAX FILING FOR 2015. IS THERE A WAY TO GET IT?

admin

Apr 3, 2017

If you have already filed your 2015 return with the IRS and you need a copy of that return, you can request a copy of you return from your tax preparer. You can also request a transcript of your return online from the IRS by clicking here.

kelly

Nov 13, 2017

I filed my 2015 taxes in October 2, 2017, i have not yet received my refund and i have used the tool on the site.

admin

Nov 14, 2017

Please contact us by our live chat support or by phone at (877) 289-7580 during our hours of business Monday-Friday, 10am-5pm EST (excluding holidays) for further assistance. Using the IRS tool, it should indicate when your refund has been disbursed, and it should arrive shortly from the date indicated on their website.