Nov 16, 2023

Nov 16, 2023Significant Changes for 2024 New Tax Brackets.

The Internal Revenue Service has taken steps to ensure that the new 2024 tax brackets reflect the current consumer price index. This 5.4% upward adjustment is especially notable compared to the 7% increase from last year, one of the most considerable adjustments the IRS has made in recent years. The new limits for 2024 will be set according to this formula and should accurately account for inflation developments in our current economy.

In anticipation of 2024, taxpayers should be aware of new income limits for IRS tax brackets. To account for inflation, these thresholds have been adjusted from previous years, which may provide a much-needed financial break to those filing taxes in 2024. Here’s how to keep up with your bracket.

Year after year, taxpayers are affected by changes to tax brackets and other areas, such as retirement fund contribution limits due to inflation. This variation helps prevent so-called “bracket creep,” which is when a person’s earnings puts them in a higher income tax bracket while their basic standard of living remains unchanged. To combat this situation, annual adjustments are made by the Internal Revenue Service (IRS).

Taxpayers may benefit from the higher thresholds, as more of their taxable income will likely fall into a lower tax bracket. Therefore, these earners can get some respite from taxes when filing their 2024 taxes in early 2025.

New Tax brackets for the 2023 tax year, taxes which are due in 2024

The New 2024 Tax Brackets

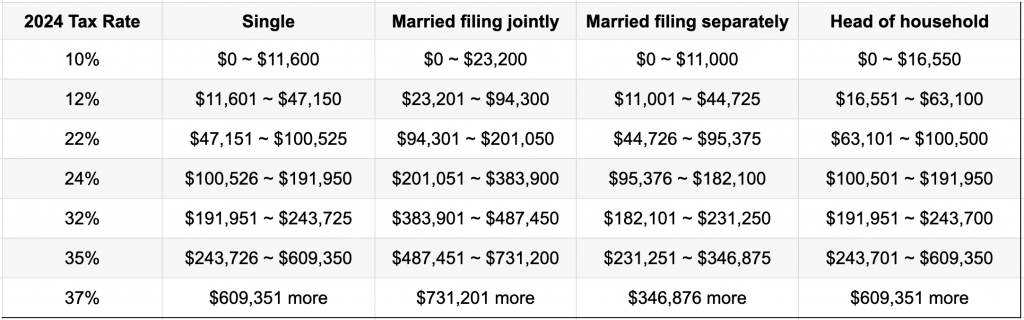

For tax year 2024, U.S. taxpayers can expect an uptick in their federal income taxes. With seven rates set by the 2017 Tax Cuts and Job Act, people filing either individually or as married couples will see a 5.4% increase in their brackets across each of these bands: 10%, 12%, 22%, 24%, 32%, 35% and 37%.

The New 2024 Tax Brackets for married couples filing jointly

Filing jointly as a married couple in the United States has distinct tax consequences; depending on one’s taxable income, various rates apply. For instance, any income up to $23,200 would be taxed at 10%, while any above $731,200 would see the highest rate of 37%.

When it comes to taxes in the United States, there often needs to be more understanding about how they are calculated. Contrary to popular belief, the highest tax rate an individual may be subject to isn’t applied to every dollar of their income. Instead, progressive tax rates are used, which means that each tax bracket a person falls under will have its applicable rate.

For the 2024 new tax bracket, the federal government has shifted some of taxpayers’ income into lower tax brackets. For instance, single filers with taxable income up to $11,600 will pay 10% in taxes that year – a full $600 more than they would have paid in 2023 when the same bracket was limited to the first $11,000.

2024 New Tax Brackets for Single Filers

In order to keep up with inflation, U.S. tax law dictates that income limits for each bracket must increase annually. As of this year, those limits have gone up by 5.4%.

The marginal rate is the maximum taxation that you are liable for. However what counts is the effective tax rate, which encompasses all of the taxes imposed on different parts of one’s income. Essentially, this amount reflects a person’s actual rate of taxation.

The new 2024 tax brackets for head-of-household filers

For head-of-household filers, their 2024 tax brackets have been established. Individuals filing taxes as a head of household will face a 10% rate on their first $16,550 taxable income. Any income above that threshold will be taxed at 37%, beginning at $609,350.

2024 New Tax Standard Deduction

As of 2024, taxpayers will see an increase in their standard deduction, according to a report from IRS. Specifically, married couples filing jointly will see an extra $1,500 – bringing their total up to $29,200. This is a boost of 5.4%.

For the upcoming tax season, taxpayers who are unmarried and filing separately will receive a standard deduction of $14,600 – an improvement of $750 from last year. Meanwhile, heads of households can count on a boost in their standard deduction to $21,900 – up by $1,100 compared to 2019 taxes.

How to Determine Your New 2024 Tax Bracket

When it comes to taxation, understanding your marginal tax bracket is crucial. You’ll need to calculate your highest taxable income as accurately as possible to do this.

Consider a married couple bringing in an annual gross income of $150,000. After subtracting the 2024 standard deduction, they are left with taxable income worth $120,800. Therefore, the marginal tax rate applicable to them would be 22%.

However, their effective tax rate is much lower:

When it comes to taxes, individuals get a break when it pertains to their first $23,200 of income. While their effective tax rate is significantly lower than average, people who make between $23,200 and $94,300 will still be expected to pay 12%, amassing a total of $8,532 in taxes. Those with incomes ranging from $94,300 to $120,800 would be lucky enough to enjoy a much lower effective tax rate. For this bracket, taxes amount to 22%, which adds up to $5,830. Together, their federal income taxes would come to $16,682 – an effective rate of 14%.

Higher FSA, HSA Limits in 2024

In an effort to help taxpayers cover medical expenses, new regulations have been issued by the IRS, increasing limits for tax-advantaged accounts. Such accounts provide people with financial assistance when paying for related costs.

The Internal Revenue Service announced that in 2024, the limit for Flexible Spending Accounts (FSAs) will be increased to $3,200 from the current level of $3,050. These accounts allow individuals to set aside pre-tax dollars, which can then be used to pay for short-term health care expenses.

IRS recently announced modified limits for contributions to Health Savings Accounts (HSAs) for those with a high-deductible health care plan. Single taxpayers will be able to contribute up to $4,150 in 2024 – an increase of 7.8% from present limits. Similarly, families now have a contribution limit of $8,300 – a rise of 7.1%.

Individuals aged 55 and over can add an extra $1,000 to their health savings accounts (HSAs), a figure that remains unchanged from the previous year.

Tags:

Leave a Reply

Your email address will not be published. Required fields are marked*

Don’t Miss Any Updates

Sign up with your email to receive latest updates.

admin

admin No Comments

No Comments