Dec 9, 2022

Dec 9, 2022The 2023 tax year will see some changes to the limits and thresholds on some well-known tax provisions as a result of inflation adjustments announced by the IRS. These include increases to the income thresholds for the 2023 tax brackets, which could mean that many people may pay less in taxes in 2024.

As we head into another tax season, it’s important to be aware of the major changes made to the 2023 tax brackets and tax code. One of the most significant changes is how inflation is considered when determining your tax bracket. This change is known as “bracket creep,” and it can have a major impact on your taxes. In order to prevent bracket creep, the government makes annual adjustments to the tax code. This year, those adjustments will impact taxpayers’ incomes in 2023. Knowing about the changes now can help you plan ahead and ensure you’re prepared come tax time.

2023 Tax Brackets and Tax Rates

There are seven different tax brackets that the government imposes on citizens in the United States. The marginal rates for these brackets are 10%, 12%, 22%, 24%, 32%, 35%, and 37%. These rates will not change in 2022. However, the income thresholds that dictate which bracket a person falls into will be significantly adjusted for 2023.

The new tax brackets for 2023 have been released, and there are some changes that taxpayers need to be aware of. For example, the maximum income for a married couple filing jointly to remain in the 12% bracket has increased from $83,550 in 2022 to $89,450 in 2023. Toggle between the tabs in the chart below to explore how income thresholds will change across all filing statuses in 2023.

2023 Standard Tax Deduction

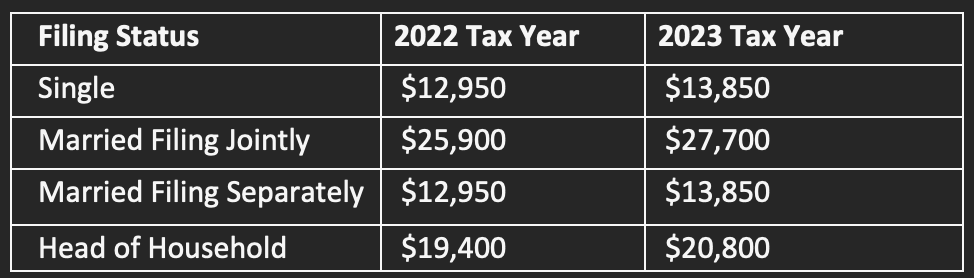

The IRS offers a deduction for 2023 taxpayers who do not itemize their taxes. This is known as the “standard deduction.” For the 2023 tax year, the amount of the deduction will increase by $900 for single filers and those married filing separately, $1,800 for married couples, and $1,400 for heads of household. In addition, the additional deduction for those over 65 or blind (up from $1,400 in 2022) and $1,850 higher for those also unmarried and not a surviving spouse (up from $1,750 in 2022).

2023 Capital Gains Tax

Different types of taxes are assessed on different types of income. For example, a person’s earnings from their job are taxed as wage income, while the profits generated from selling an asset, such as a stock or cryptocurrency, are taxed as a “capital gain.”

Short-term gains (capital gains on assets held for less than one year) will be taxed in 2023 at the same tax rate as your other ordinary income. However, long-term gains (capital gains on your assets held for more than one year) get special tax rates: 0%, 15%, or 20%.

Tags:

Leave a Reply

Your email address will not be published. Required fields are marked*

Don’t Miss Any Updates

Sign up with your email to receive latest updates.

admin

admin No Comments

No Comments