Nov 8, 2021

Nov 8, 2021If you need to file back taxes for 2019, a tax calculator is something you’ll want to have in your back pocket during the process. A federal tax calculator for the 2019 tax year will give you an estimate of what your tax liability was for that year and can help guide your next steps.

Use a 2019 tax calculator to figure out which of the three possible scenarios of where your relationship with the IRS currently stands applies to you:

- The taxes that have already been withheld from your paychecks from 2019 combined with the tax credits you are eligible for may cover your 2019 tax bill.

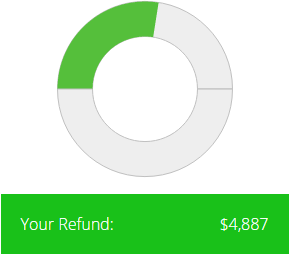

- If you’ve had too much tax withheld from your paychecks, then you should expect a tax refund when you file, and the 2019 tax calculator can tell you how much that will be.

- If you’ve not had enough withheld or prepaid based on estimates (if you’re self-employed), then you may still need to pay the rest of your tax bill.

Link to 2019 Tax Calculator

Gather up your documents and get started today with our easy-to-use online federal tax calculator for 2019. And if you need help with your tax returns for any other year, we have the tools for that too. We offer tax calculators for each year going back to 2011, and we can help you prepare prior-year tax returns for each year going back to 2008. So visit PriorTax.com today to get up to date with your taxes.

Is the federal tax calculator for 2019 safe to use?

When you use any of our online prior-year tax calculators, it will be completely anonymous. You don’t need to create an account with us or enter any identifying personal information to use it.

What do information do I need to use a federal tax calculator for 2019?

When you open our 2019 tax calculator, you’ll find three different sections. The information needed to estimate your tax bill has been divided into three parts to make things as straightforward as possible.

The first section is ‘Family’. This is where you’ll provide your general personal information, including things such as age, filing status, and the number of dependents you are claiming.

The second section is ‘Income’. This is where you’ll need the tax paperwork you received from work and from any banks or other financial institutions. You’ll need to enter

- any income you received as an employee or during unemployment

- any income earned from investments, including any retirement plans

- any income earned from either self-employment or your own business

- any other forms of income such as Social Security benefits, federal tax withheld from benefits, or alimony payments

This information is used to determine your total income for 2019.

The third and final section is ‘Deduction and Credits’. This is where any estimated federal and state tax payments you have already made are taken into account. You will also enter information about household, education, and unreimbursed work expenses and information about retirement savings plans and donations made during the year.

What information does the federal 2019 tax calculator provide?

In addition to your estimated refund or outstanding tax bill, you will also see a breakdown of the numbers that contributed to this amount. You will be given line-by-line details outlining your:

- Total Income

- Above the Line Deductions

- Adjusted Gross Income

- Standard Deduction

- Total Exemptions

- Taxable Income

- Regular Taxes

- Alternative Minimum Tax

- Tax Credits

- Additional Taxes

- Tax Payments

- Refundable Credits

What can I do if I am missing any information needed for the federal tax calculator for 2019?

The 2019 tax calculator, like all of our online prior-year tax calculators, can only provide an estimate based on the information that you enter into the form. If you enter estimates or guesstimates for details like your wages, keep in mind that our calculation will be based on those numbers. Remember that your exact tax refund or tax bill may change once you enter your exact numbers.

It is always important to keep track of any tax documents you receive throughout the year, like your W-2 forms from your employers or 1099 forms from your bank or for any other source of income. If you are missing any of these forms or never received them, a good first point of call will be your work or your bank.

However, the IRS understands that there are times when you aren’t able to obtain copies of these documents. If this is your situation, you can contact the IRS to request a free tax transcript from the IRS. These are available for the current tax year as well as for the past three years and will summarize your return information.

Sometimes you need an actual copy of your prior tax return rather than just a summary. For those situations, a copy of your prior tax return can be requested from the IRS for a fee. You are able to request full copies for the current tax year and for the past six years.

The federal 2019 tax calculator estimates that I am owed a refund. What next?

Everyone has three years from the original filing deadline to file their prior-year tax return and claim their refund. When you don’t have an outstanding tax bill, you are not subject to any IRS penalties for not filing your return on time. And you have until April 15, 2023, to claim your refund for the 2019 taxes you overpaid.

The federal tax calculator for 2019 estimates that I have outstanding taxes to pay. What next?

Unlike the deadline to claim a refund, there is no deadline to file your 2019 tax return.

There are penalties for both late filing and late payment that the IRS will levy. These additional charges will accumulate over time. However, the late filing penalty will usually work out to be more costly than the late payment penalty. So it’s often a good financial decision to file your prior-year return for 2019 as soon as possible, even if you are not currently in a position to pay the full bill.

Tags:

Leave a Reply

Your email address will not be published. Required fields are marked*

Don’t Miss Any Updates

Sign up with your email to receive latest updates.

admin

admin No Comments

No Comments